Data-Driven Debt Pricing: A Systematic Literature Review

This review explores the potential of machine learning in debt pricing, with a focus on reinforcement learning. It concludes that more research is needed and highlights issues with reproducibility and comparability of results.

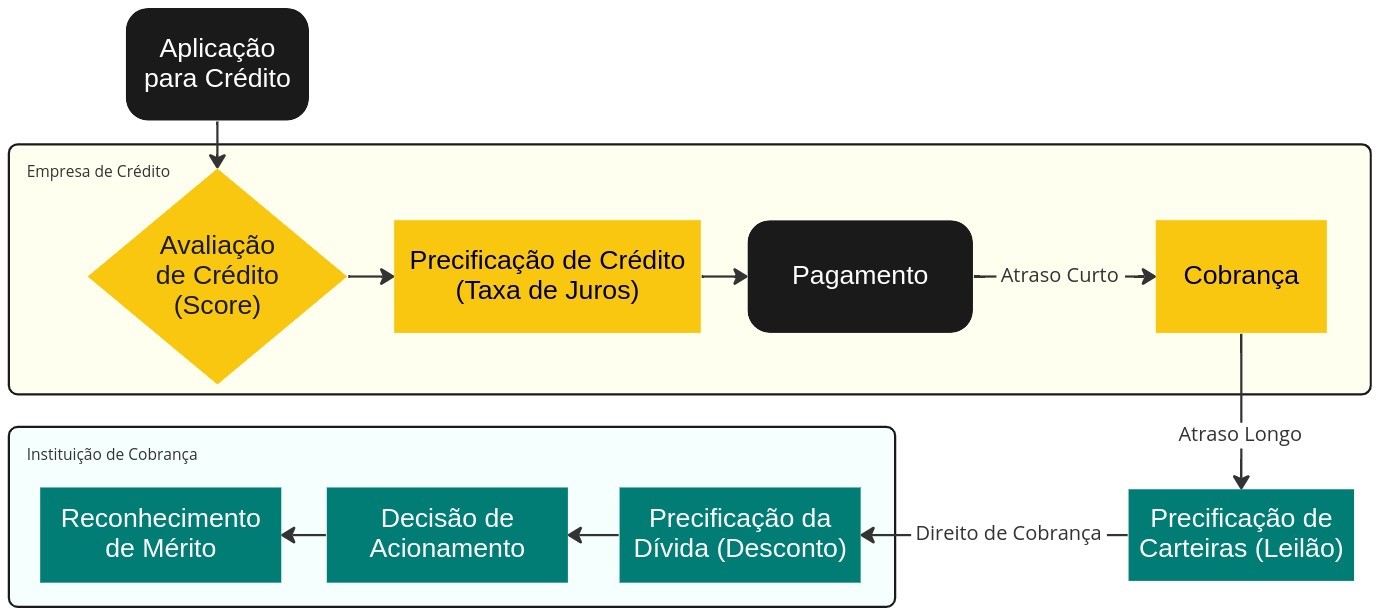

The Debt Collection (RC) market presents vast potential for enhancing its processes through the implementation of Machine Learning (AM) techniques, due to the profusion of data accumulated by debt collection institutions. This Systematic Literature Review aims to identify techniques applied to the specific predicament of Debt Pricing (PD), especially Reinforcement Learning, and to highlight research opportunities that remain unexplored. A research methodology is instituted, and statistics of the findings are presented, as well as a synthesis of the main methods identified. It is concluded that the optimization of PD is still an open question and that the use of AM in RC still lacks comprehensive studies. Furthermore, the reviewed works evidenced a deficiency in reproducibility and comparability of the results obtained.